15 min read

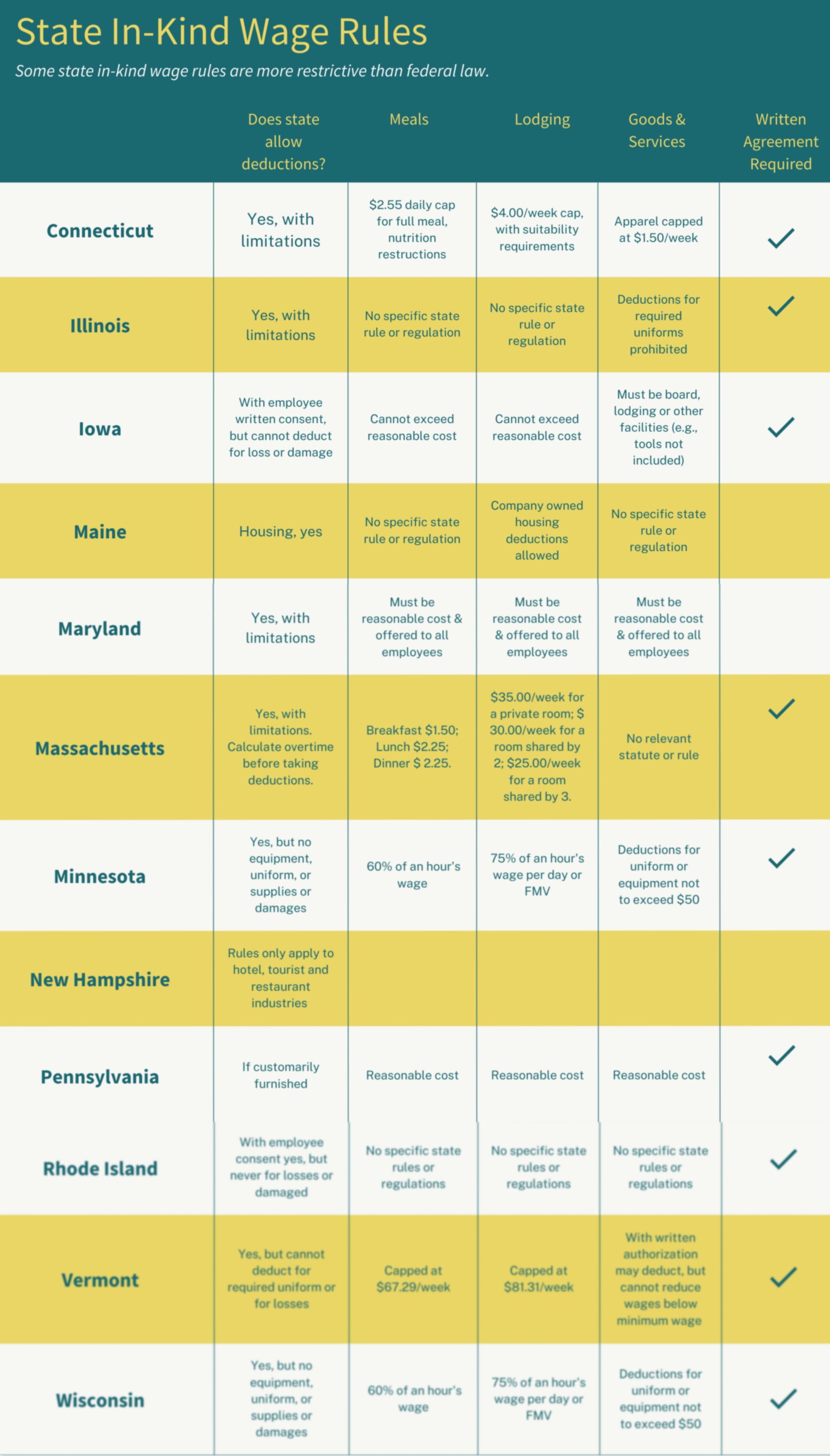

Some states prohibit employers from paying in-kind payments altogether or prohibit certain types of in-kind payments. Some states prohibit in-kind payments altogether if doing so will reduce cash wages below the minimum wage. Other states allow in-kind payments so long as certain factors are met, including that it’s voluntarily accepted by the worker and not a condition of employment. In other words, in some states, the workers must ultimately have the choice of whether to receive cash or non-cash wages.

Remember that not all states require agricultural labor to meet minimum wage obligations. The rules in the chart below assume that minimum wage rules apply to the employee in question. Please see your state guide on minimum wage obligations to determine when you are obligated to pay a minimum wage rate and what that rate is. Generally, once you assign non-agricultural labor (read more about the distinction between agricultural and non-agricultural labor here), or if you have a large farm (that exceeds the 500 man-day size threshold), you will be obligated to pay the minimum wage rate. The exact rate will vary by jurisdiction.

To get more information on your state’s rules, you can contact your state’s Department of Labor or talk with an attorney who can advise you.

More states to come soon!

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28588

Join Farm Commons on Thursday, April 24, 2025, at 11 AM CT for a free webinar, where we will share new and improved resources available, and discuss the termination and reapplication activity surrounding the Partnerships for Climate Smart Commodities program, including the opportunity for appeal.