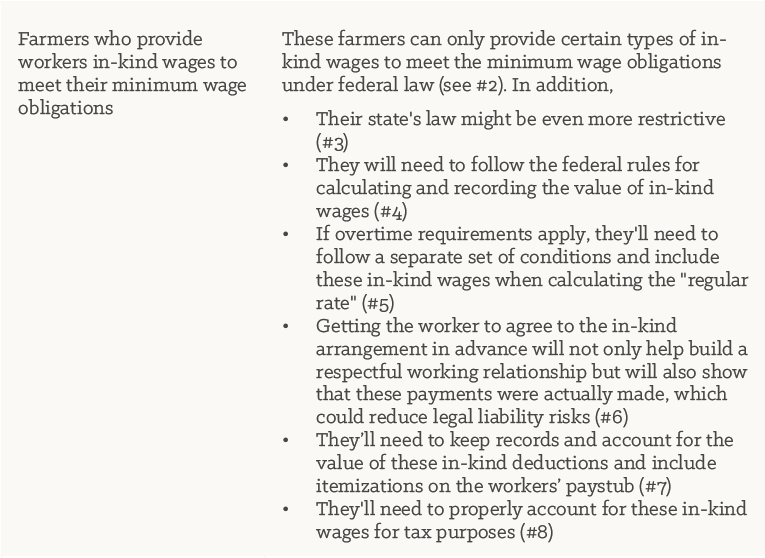

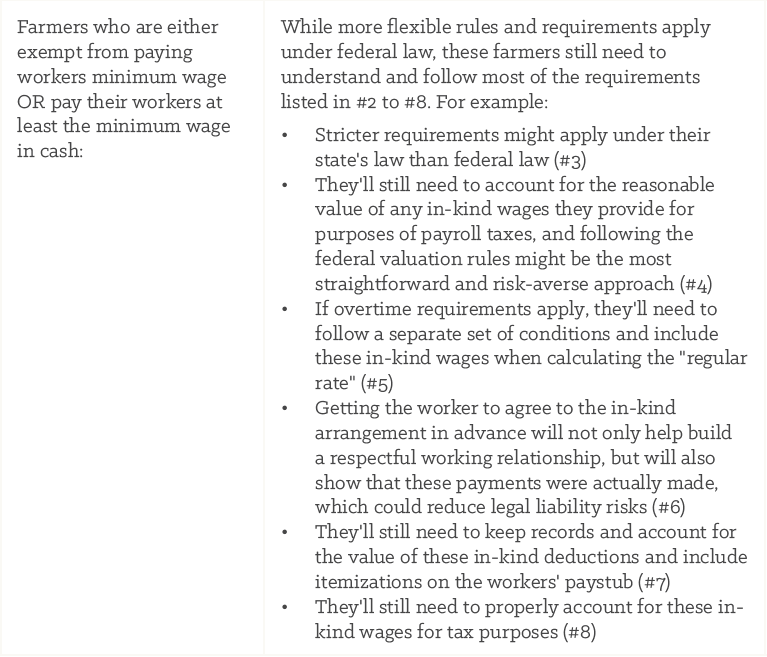

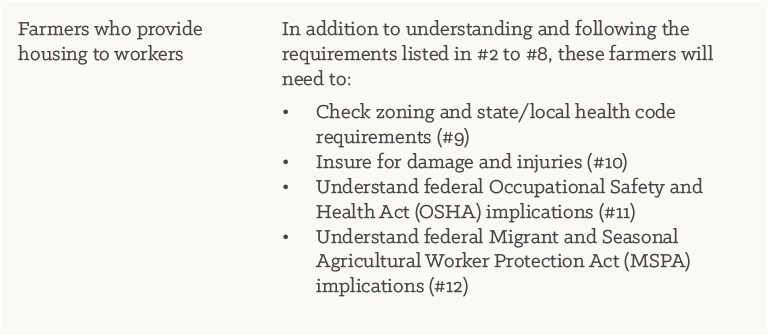

In summary, here’s a roadmap that farmers can navigate when paying workers in goods and services rather than cash:

Paying workers in goods and services comes with a unique set of legal implications, especially when those goods and services are being used to meet minimum wage obligations. By taking time to know and do the 12 things highlighted in this guide, farmers will be better equipped to decide whether paying their workers in-kind is a good option for them, and, if so, how to do it while minimizing legal risks.

Nevertheless, this guide is not exhaustive in scope. It merely identifies and provides a general overview of the significant legal issues that arise when farmers pay their workers in-kind payments. Farmers will likely still be left with questions. Farmers can learn more about specific issues—namely certain state requirements, the federal commodity wage exception to payroll taxes, federal OSHA implications and federal migrant worker laws—by reviewing the resources in the Appendices.

Regardless, offering workers in-kind payments can be complex and tedious and carries a certain degree of legal risk. Farm Commons strongly recommends that farmers paying their workers in-kind work closely with an accountant or tax attorney along the way to be sure that all the state and federal legal limitations and requirements are being met.