Land Contract1

This LAND CONTRACT (“Contract”) is made between Penny Gordon (“Seller,” whether one or more) and Claire and Frank O’Conner (“Buyer,” whether one or more) as of December 31, 2015 (“Contract date”).

Seller and Buyer agree to the following terms:

Land Description

The Seller warrants that she is the legal owner of real property in Coral County, Sun State, described as:

Common address: 1234 Zinnia Land, Zinc, Sun State, 55555

Legal Description: Lot 6,7, and the South 1⁄2 of Lot 3, West 60 feet of South 1⁄2 of Lot 4, West 60 feet of Lot 5 and Lot 8, Block 20, OLD SURVEY, Zinc, Coral County, Sun State.2

The above referenced real property is hereinafter referred to as “the Land.”

Purchase Price and Terms of Payment

Seller agrees to sell the Land and Buyer agrees to purchase the Land upon the Buyer paying Seller the sum of One Hundred Thousand Dollars ($100,000) as follows:

a. Down Payment. Buyer shall pay Ten Thousand Dollars ($10,000)3 at the execution of the Contract.

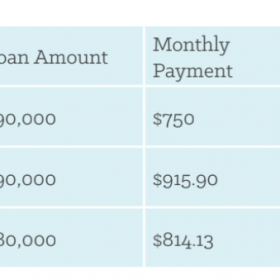

b. Monthly Installments with Interest.4 The balance, together with interest on the whole sum at the rate of 2% per annum, shall be payable in 120 monthly installments.5 The monthly installments in the amount of $915.90 per month shall begin on January 1, 2016 and be due and payable on the first day of each month through December 2025 or until the full balance is paid, whichever is sooner. Interest shall be computed monthly and each payment shall be credited first to any late charge due, second to interest, and the remainder to principal.

Alternative 1: Monthly installments without interest.6 The balance shall be payable in 120 monthly installments in the amount of $ 750.00. The monthly installments shall begin on January 1, 2016, and be due and payable on the first day of each month through December 2025 or until the full balance is paid, whichever is sooner.7

Alternative 2: Balloon payment.8 The balance shall be payable, together with interest on the whole sum at the rate of 2% per annum in 60 monthly installments in the amount of $500.00. The monthly installments shall begin on January 1, 2015, and be due and payable on the first day of each month through December 2019. The remaining principal and interest, in the sum of $79,907.95, shall be paid in full on or before December 31, 2019. Interest shall be computed monthly and each payment shall be credited first to any late charge due, second to interest, and the remainder to principal.

Method of Payment

Unless otherwise provided in writing by Seller, all payments shall be delivered to Seller at 1830 N. Tulip Ave, Sunny, CA, 55555. All payments shall be made in the form of cash or check and be hand delivered or postmarked on or before the date the payment is due.9

Prepayment

a. No Penalty. Buyer retains the right to fully or partially prepay the balance owed on the Contract at any time without penalty.10

Alternative 1: Buyer retains the right to fully or partially prepay the Contract at any time after [December 31, 2017].11

Alternative 2: No prepayments are allowed under the Contract without written permission from the Seller.12

b. Effect of Partial Prepayment. Any partial prepayment will apply first to the amount then due, including unpaid accrued interest, and the balance shall then be applied to the principal portion of future monthly installments in the inverse order of their maturity.13 Partial prepayment shall not postpone the due date or amount of the installments to be paid pursuant to the Contract until the balance is paid in full.

Evidence of Title

Seller warrants that the title to the Land is only subject to the following:

a. applicable laws, ordinances, and regulations

b. the lien of real estate taxes and instruments of special assessments which are payable by Buyer pursuant to paragraph 7 (Real Estate Taxes and Assessments) of the Contract

c. covenants, conditions, restrictions, or declarations of record

d. reservation of mineral rights by the State

e. easements listed on the deed or recorded with the county14

Recording of Contract

Buyer shall, at Buyer’s expense, record the Contract in the Coral County Recorder’s Office within four (4) months after the Contract date.15 Buyer shall pay any penalty imposed under applicable state laws or regulations for failure to record the Contract.

Possession and Use

Buyer shall have the right to possession of the Land from and after the Contract date and be entitled to retain possession so long as there is no default on Buyer’s part in carrying out the terms and conditions of the Contract.16 Buyer agrees to: (a) use, maintain, and occupy the Land in accordance with any and all applicable building and use restrictions; (b) keep the Land in accordance with all police, sanitary, or other regulations imposed by any governmental authority, and (c) keep and maintain the Land and the buildings in as good condition as they are at the Contract date and not to commit waste, remove or demolish any improvements thereon, or otherwise diminish the value of Seller’s security in the land—without the written consent of Seller.17

Delivery of Deed and Deed Tax

Upon full performance of the Contract, Seller shall execute, acknowledge, and deliver to Buyer a General Warranty deed18 in fee simple,19 in recordable form, conveying to Buyer marketable title to the Land, free and clear of all liens and encumbrances, except those created by the act or default of the Buyer or acknowledged within the Contract. Upon transferring title to Buyer, Seller shall pay the deed tax.20

Real Estate Taxes and Assessments

a. Seller’s Warranty. Seller warrants that all real estate taxes and assessments which were due and payable before the Contract date are paid in full.

b. Buyer’s Obligations. Buyer shall pay all real estate taxes and assessments for the Land that are due and payable after the Contract date. Such payments shall be made before any penalties for not-payment are incurred. Buyer shall submit receipts to Seller upon request, as evidence of payment.21

Damage to Property and Property Insurance

a. Property Insurance. Buyer shall keep the Land and all buildings, improvements, and fixtures insured against loss by fire, lightning, and other hazards covered by standard extended insurance coverage, including but not limited to: vandalism, malicious mischief, burglary, and theft. Such insurance shall be in amounts reasonably satisfactory to Seller, which at a minimum is an amount equal to the full replacement value of the buildings, improvements, and fixtures on the Land without deduction for physical depreciation.22

b. Loss Payable Clause. The insurance policy shall contain a loss payable clause in favor of the Seller. Such clause shall provide that the Seller’s right to recover under the insurance shall not be impaired by any acts or omissions of Seller or Buyer, and that Seller shall otherwise be afforded all rights and privileges customarily provided to a mortgagee under a standard property insurance policy.23

c. Notice of Damage. In the event of damage to the Land, Buyer shall promptly give evidence and notice of damage to the insurance company and Seller.24

d. Application of Insurance Proceeds. If the Land is damaged by fire or other casualty, the insurance proceeds paid on account of such damage shall be applied to the amounts payable under the Contract, even if such amounts are not then due, unless Buyer elects to conduct Repairs as specified in the next paragraph. Insurance proceeds applied to the amounts payable under the Contract shall be applied pursuant to Section 3(b)–Prepayment. The balance of insurance proceeds, if any, shall be the property of Buyer.25

e. Buyer’s Election to Conduct Repairs. If Buyer is not in default under the Contract, or after curing any such default, Buyer may elect to have the amount of insurance proceeds necessary to repair, replace, or restore the damaged Land (the “Repairs”) deposited in escrow with a bank or title insurance company qualified to do business in the State of Sun State or any other party mutually agreeable to Seller and Buyer.26

i. Terms of escrow account. Buyer’s election to place insurance proceeds in escrow to conduct Repairs must be made to the Seller in writing within sixty (60) days after the damage occurs. Placing the insurance proceeds in escrow will only be permitted if Seller approves Buyer’s plans, specifications, and contracts for the Repairs; Seller shall not unreasonably withhold or delay approval. If such funds are insufficient, Buyer shall, before the commencement of the Repairs, deposit into escrow additional funds necessary to cover the full cost of the Repairs as well as any escrow account fees and costs. If such funds exceed the full cost of Repairs and escrow account fees and costs, the escrow account shall be closed and any remaining funds shall be applied to the amounts payable under the Contract. Such amounts shall be applied pursuant to paragraph 3 (prepayment) of the Contract. The balance of insurance proceeds, if any, shall be the property of Buyer. All escrowed funds shall be disbursed in accordance with generally accepted sound construction disbursement procedures.27

ii. Terms of repairs. Buyer shall complete the Repairs as soon as reasonably possible. Repairs should be completed in a good workmanlike manner in accordance with best practices in the industry. All Repairs shall be completed by Buyer within one (1) year after the damage occurs, unless Buyer and Seller otherwise agree in writing, or if completion within one year is commercially infeasible.28

Injury or Damage Occurring on the Land and Liability Insurance

a. Liability Insurance. Buyer shall, at Buyer’s own expense, procure and maintain liability insurance against claims for bodily injury, death, and personal property damage occurring on or about the Land in amounts reasonably satisfactory to Seller and naming Seller as an additional insured.29

b. Seller’s Liability. Seller shall be free from liability and claims for damages by reason of injuries occurring to any persons or property while on or about the Land after the Contract date. Buyer shall defend and indemnify Seller from all liability, loss, cost, and obligations, including reasonable attorneys’ fees, on account of or arising out of any such injuries.30

c. Buyer’s Liability. Buyer shall have no liability obligation to Seller for such injuries which are caused by the negligence or intentional wrongful acts or omissions of the Seller.31 Seller shall defend and indemnify Buyer from all liability, loss, cost, and obligations, including reasonable attorneys’ fees, on account of or arising out of any such injuries.

Insurance Generally

The insurance which Buyer is required to procure and maintain pursuant to Sections 9 and 10 of the Contract shall be issued by an insurance company or companies licensed to do business in the State of Sun State and acceptable to the Seller. The insurance shall be maintained by the Buyer at all times throughout the duration of the Contract. Buyer shall deliver to Seller a duplicate original or certificate of such insurance policy or policies. The insurance policies shall provide for at least ten (10) days written notice to Seller before cancellation, non-renewal, termination, or change in coverage. Buyer shall pay the insurance premiums when due and submit receipts to Seller upon request, as evidence of payment.32

Improvements

Buyer may make improvements to the property only upon the prior written consent of the seller. The seller may require additional approval of specific designs and construction terms before any improvements are made. The term “improvements” as used herein means building or installing permanent structures, fixtures, or other elements of infrastructure on the land that cannot be removed without causing permanent damage to the Land. Unless otherwise agreed to in writing by the parties, buyer shall incur the full cost of improvements. If buyer removes any structure or item that buyer builds or installs that is not considered an “improvement,” buyer is responsible for repairing any and all damages incurred in its removal.33

Waste, Repair, and Liens

Buyer shall neither commit any affirmative or permissive waste34 or allow waste to be committed on the Land, nor remove or demolish any buildings, improvements, or fixtures now located on or a part of the Land, nor remove or demolish any improvements later located on or a part of the Land, nor create or permit to accrue liens or adverse claims against the Land which constitute a lien or claim against the Seller’s interest in the Land without the written consent of Seller.35 Buyer shall keep the Land in good tenantable condition and repair. Buyer shall pay to the Seller all amounts, costs, and expenses, including reasonable attorneys’ fees, incurred by the Seller to remove any such liens or adverse claims.

Condemnation

If all or any part of the Land is taken in condemnation proceedings instituted under the power of eminent domain or is conveyed in lieu thereof under threat of condemnation, the money paid pursuant to such condemnation or conveyance shall be applied to the amounts payable by the Buyer under the Contract, even if such amounts are not then due. Such amounts shall be applied pursuant to paragraph 3 (prepayment) of the Contract.36

a. Condemnation or Conveyance of Entire Land. If the Land in its entirety is condemned and the payment amount does not fully cover the remaining payments owed to the Seller, the Contract shall terminate, and the Buyer shall owe no future payments, after the date of condemnation. If the entire property is condemned and the payment amount fully covers the remaining payments owed to the Seller, any balance shall be the property of the Buyer.

b. Partial Condemnation or Conveyance. If part of the Land is condemned, such condemnation payments shall not postpone the due date of the installments to be paid pursuant to the Contract or change the amount of such installments. Any balance shall be the property of the Buyer.

Compliance with Laws

Except for matters which Seller has created, suffered, or permitted to exist prior to the date of the Contract, Buyer shall comply with all laws, ordinances, and regulations of any governmental authority which affect the Land or the manner of using or operating it, and with all restrictive covenants, if any, affecting title to the Land or the use thereof.

Protection of Interest

If Buyer fails to pay any sum of money or fails to perform any obligation required under the Contract, Seller may pay the cost of such performance, and the cost shall be payable at once by the Buyer to the Seller, with interest at rate stated in Section 2 (Purchase Price) of the Contract, as an additional amount due under the Contract. If Seller fails to pay any sum of money or fails to perform any obligation required under the Contract, Buyer may pay the cost of such performance, and if the Buyer is not in default of the Contract, the cost shall be deducted from future installments or payments, with interest at rate stated in Section 2, in inverse order of maturity. Neither shall postpone the due date of the installments to be paid pursuant to the Contract or change the amounts of such installments.37

Defaults and Remedies38

a. Time is of the essence. The time of performance by Buyer of the terms of the Contract is an essential term of this Contact.39

b. The parties stipulate that the Contract shall be treated as a mortgage under the laws of Sun State.40 Seller and Buyer agree that in the event of a default in the payment of principal or interest or default in performance of any other obligation of Buyer which continues for a period of thirty (30) days,41 Seller may only seek recourse through state mortgage and foreclosure laws. Seller hereby forfeits the right to strict foreclosure.

Alternative 1:42 Buyer agrees that in the event of a default in the payment of principal or interest which continues for a period of forty-five (45) days following the due date or a default in performance of any other obligation of Buyer which continues for a period of 12043 days following written notice thereof by Seller (delivered personally or mailed by certified mail), the entire outstanding balance under the Contract shall become immediately due and payable.44 Following any default in payment, interest shall accrue at the rate of five (5) per cent annum on the entire amount in default.

Alternative 2:45 Seller may elect to declare the Contract cancelled and terminated by notice to Buyer. If Seller elects to terminate the Contract, all right, title, and interest acquired under the Contract by Buyer shall then cease and terminate, and all improvements made upon the Land and payments made by Buyer pursuant to the Contract (including escrow payments, if any) shall belong to the Seller as liquidated damages for breach of the Contract. Any extension of time for payment shall not be valid unless in writing and signed by the Seller and Buyer.46 After service of notice of default and failure to cure such default Buyer shall surrender possession of the Land to Seller. Failure by the Seller to exercise one or more remedies47 available under this paragraph shall not constitute a waiver of the right to exercise such remedy or remedies thereafter.48

Binding Effect

The terms of the Contract shall run with the land and bind the parties hereto and the successors in interest.49

Transferability

Buyer may not transfer, assign, sell, or convey any legal or equitable interest in the property, including but not limited to a lease for a term greater than one year, without the prior written consent of Seller. Should any such transfer, assignment, sale, or conveyance occur without Seller’s written consent, the entire outstanding balance payable under the Contract shall become due immediately and payable in full at Seller’s option.50

Severability

If any one or more of the provisions contained in the Contract shall be held illegal or unenforceable by a court, no other provisions shall be affected by this holding. The parties intend that in the event one or more provisions of this agreement are declared invalid or unenforceable, the remaining provisions shall remain enforceable and this agreement shall be interpreted by a court in favor of survival of all remaining provisions.51

Headings

Headings of the paragraphs of the Contract are for convenience only and do not define, limit, or construe the contents of such paragraphs.52

Entire Agreement.

The Contract constitutes the entire understanding between the parties with respect to the transactions contemplated herein. All prior or contemporaneous agreements, understandings, or representations, oral or written, are merged into the Contract.53