Download for Later

Did you know that members can download this resource as a PDF?

8 min read

Basic guidance on the legal process of transitioning your farm business and land to new owners.

Want specialty content that goes beyond the basics?

Succession planning can be an immense undertaking. You are creating the future stage for the land, your farm operation, and your family, all of which you likely care deeply about. Where do you begin? From conservation easements, family trusts, and LLCs to capital gains, estate taxes, and gift taxes, it can be easy to get overwhelmed by the complexities and vast array of farm transfer tools and effects. Here are some tips for turning overwhelm and idleness into inspired action.

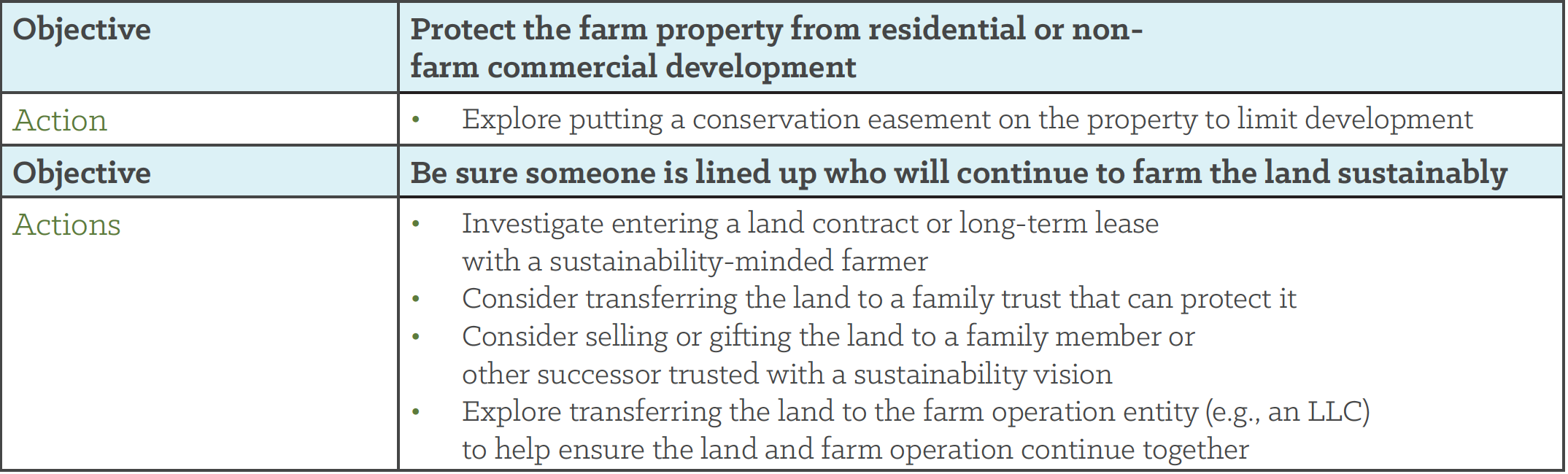

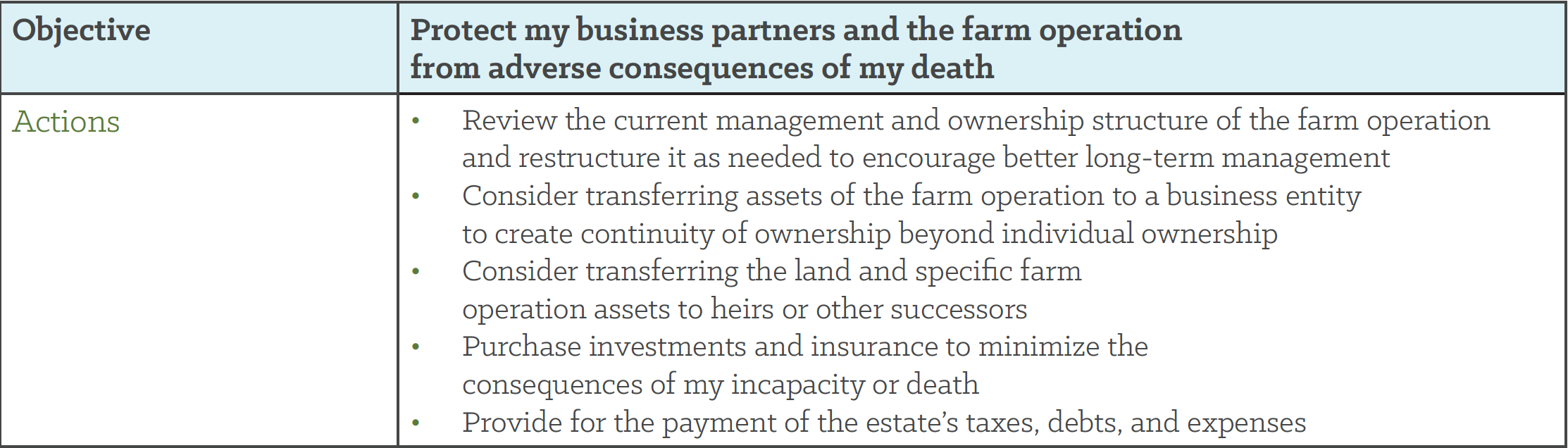

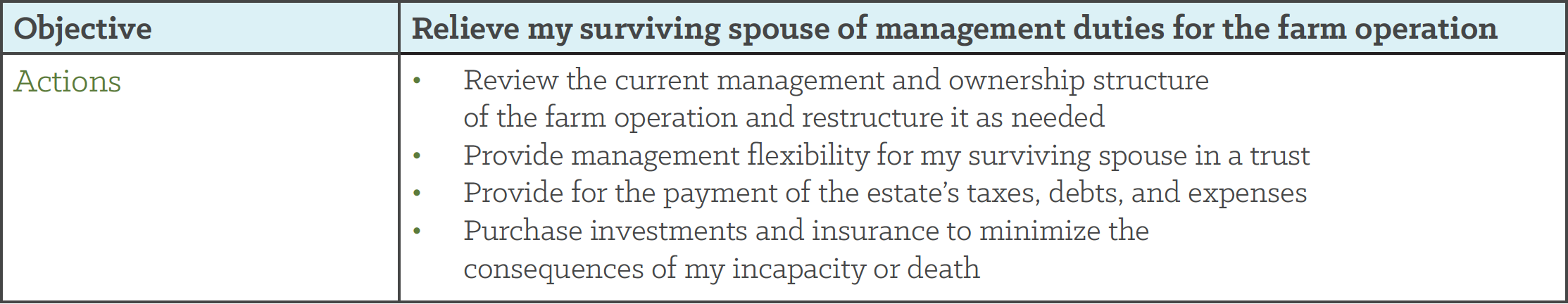

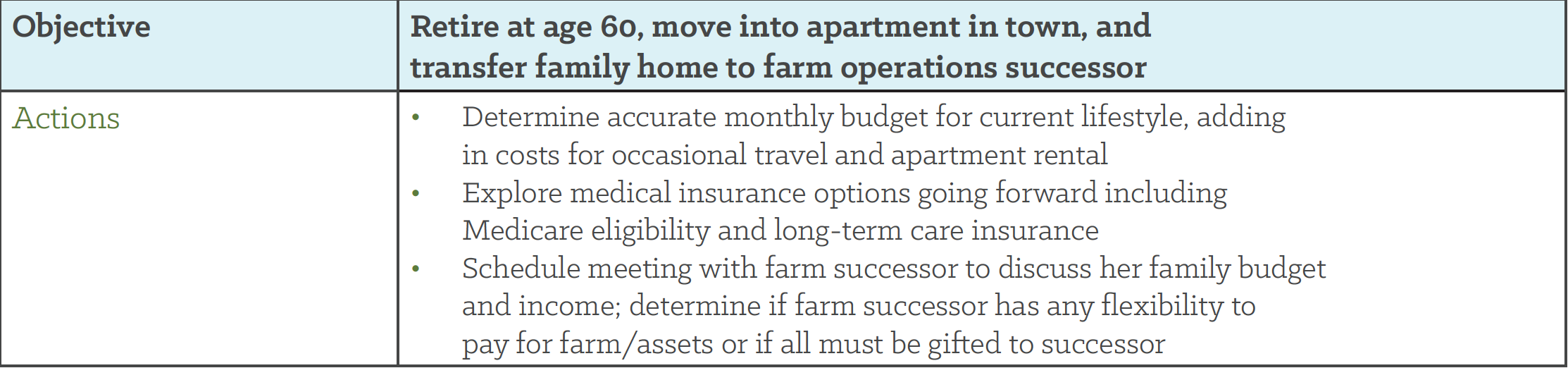

A valuable approach to succession planning is to view it through the lens of three central categories: the land, the farm operation, and you and your family. What is your ultimate vision for each? You can begin the process by creating a set of clear overarching goals and objectives for each of these dimensions. This can assist you in identifying the best estate planning tools and strategies to actualize your ideal vision for your farm transfer. If you choose to work with advisors, having clear goals and objectives can help streamline the process.

Goals vs. Objectives

Goals and objectives are often used synonymously, but they are different. Goals are long-term aspirations that are loftier and less concrete. Objectives are more specific benchmarks that can be achieved by following certain steps. Setting goals is like deciding on the ultimate destination. By identifying objectives, you carve a clear path to get there.

First step: Take some time to answer the following set of questions relating to your vision for the land, your farm operation, and your family. Then craft a set of goals and objectives for each category. Identify action steps to accompany the objectives if any come to mind. If they don’t, this might be a good place to call upon an advisor for suggestions. Use the examples provided to guide you, but be sure to create your own! The examples are meant only as a guide.

Key: Realizing your vision for the land often hinges upon how the farm property is owned and protected now and in the future. Current stakeholders in the land—partners, mortgage holders, landlords, and co-owners—also control the land’s future, so it helps to involve them right away. Here are some questions to help you identify these key players.

- Do you own the land individually or jointly with another person?

- Is the land tied to a mortgage? If so, when will you own it in full?

- Do you lease the land? If so, is there an option for you to purchase it?

- Has the land been transferred to an entity, such as an LLC, that houses the farm operation?

Key: Realizing your vision for the farm operation often hinges upon how it is managed and structured as well as its financial viability. Here are some key questions to answer to help you assess how the status of your farm operation could affect your succession plan.

*For step-by-step guidance on writing a governance document, use our Farmers’ Workbook for Creating a Governance Document.

Key: Realizing your vision for you and your family is highly interpersonal. Open and honest communication is vital. Here are some key questions to answer to help you grapple with these tough interpersonal issues.

Succession planning can be a long and intricate process. Working through the tough questions and developing clear goals and objectives is an admirable first step. A next step may be to engage with a more comprehensive guide to help you navigate some of the substantive issues. Many farmers use AgTransitions—a free online resource designed to help farmers and ranchers develop a succession plan. Plenty of other resources are out there too. Ask around to other farmers or ask your extension office what they recommend.

Regardless of your next step, here are three truths about succession planning to keep in mind through the process:

If you’re ready to dive into the legal tools to help you make a plan for passing the farm business on, read our in-depth guide Wills, Trusts and Business Structures for Farm Succession. The pointers in this guide will help whether you pass the farm on to a family member or another non-related farmer you know (or hope to find!). It covers topics from wills to trusts, Medicaid, and using business agreements to organize succession. This guide will address many potential succession plans!

For an interactive learning experience on your own schedule, take our self-paced course Legal Tools and Relationships for Farm Succession.

DISCLAIMER: This guide does not provide legal advice or establish an attorney-client relationship between the reader and author. Consult an attorney for advice specific to your situation and the state in which you operate.

Did you know that members can download this resource as a PDF?