Download this information to use later:

Did you know that members can download this resource as a PDF?

20min read

Farmers’ Guide to Business Structures excerpt - Understanding Your Options

Want specialty content that goes beyond the basics?

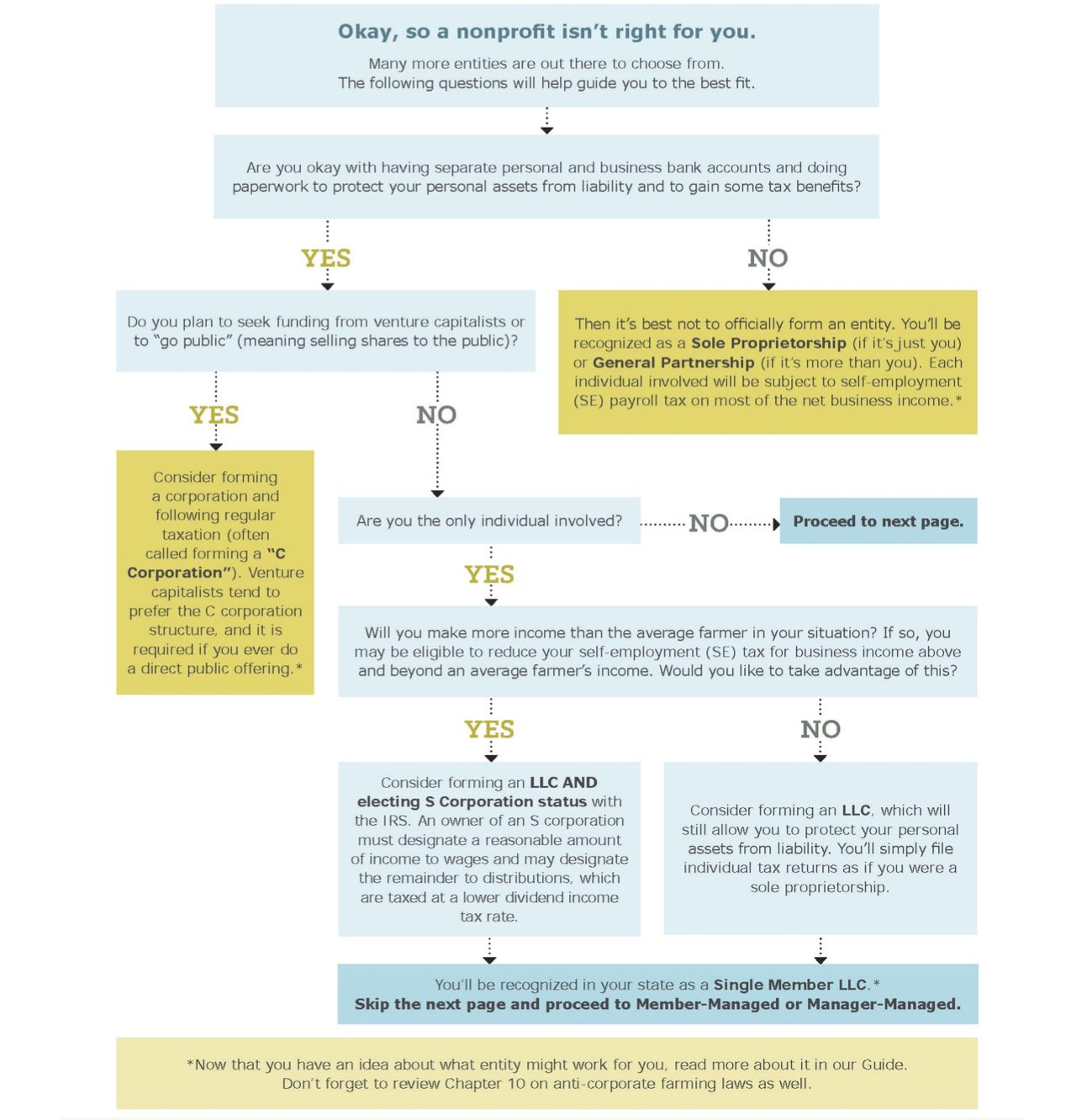

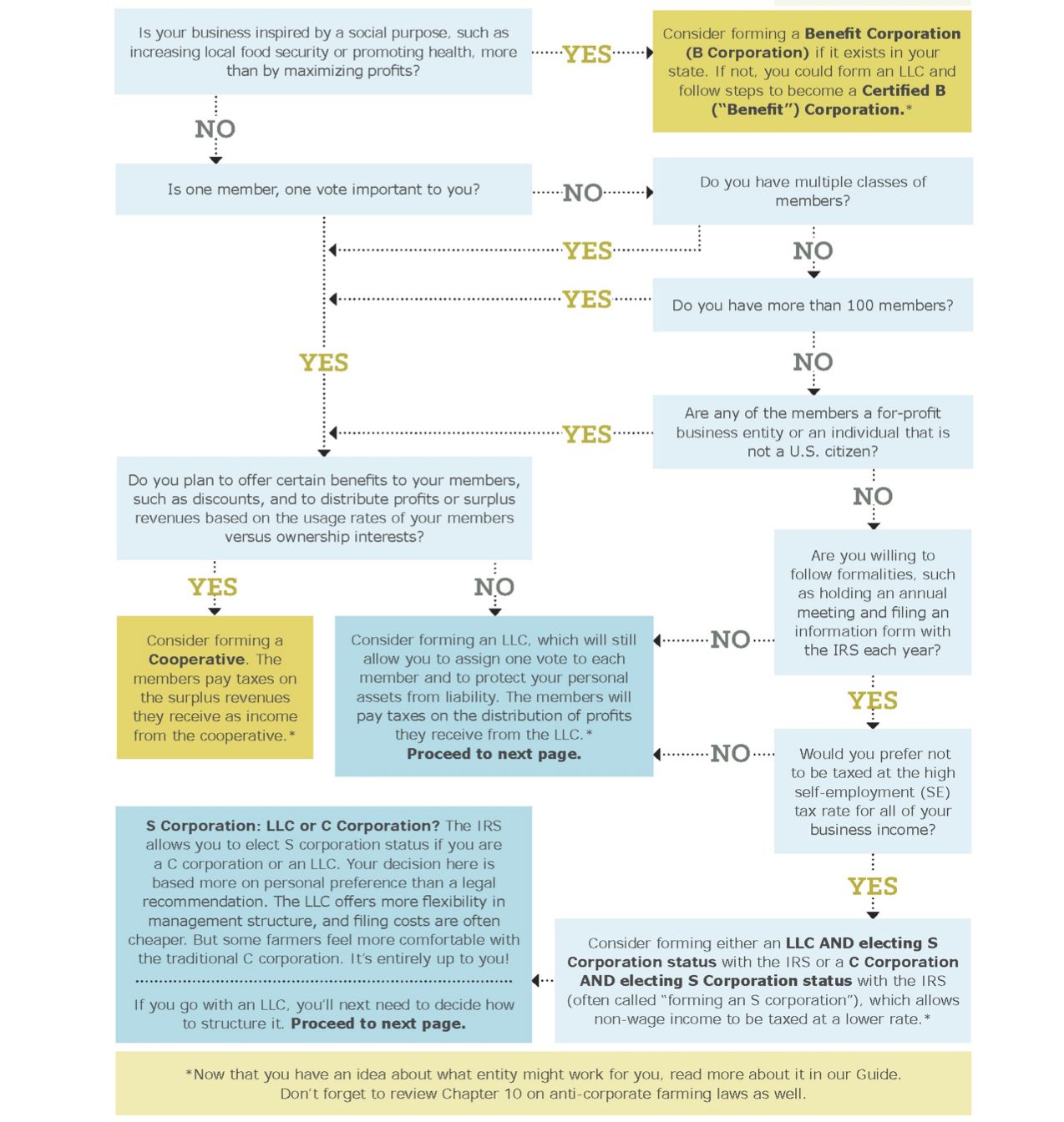

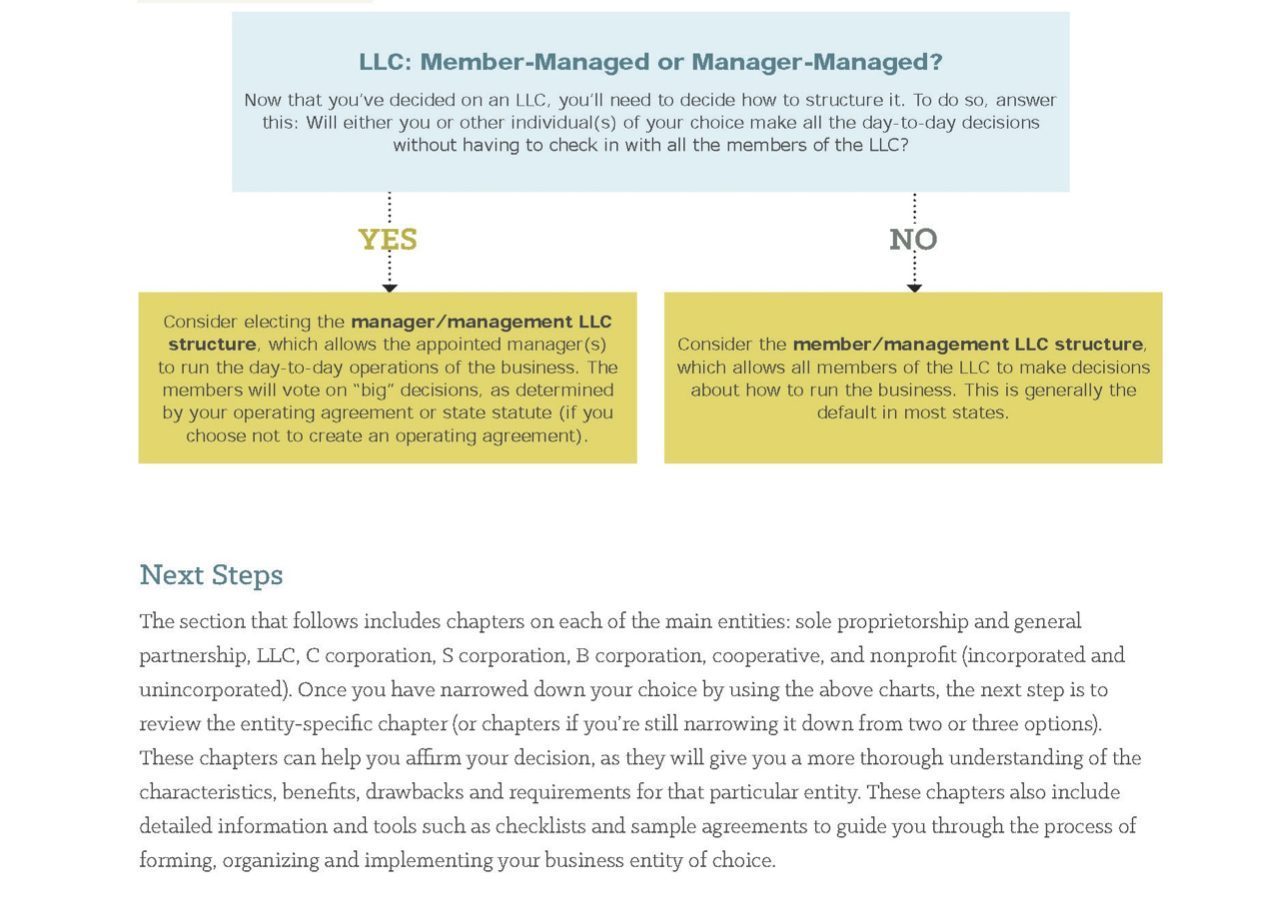

This section provides farmers with tools to help choose the best business entity for their farm operation: Entity Comparison Chart and Choose Your Entity Flowchart. Consciously choosing an entity is the first and probably most important step in running a successful farm operation. These charts will help farmers narrow down the options based on certain factors or characteristics of the business entity.

Warning: Are you already a corporation?

If you are already a corporation, don’t do anything until and unless you consult a tax professional. There can be serious tax implications when changing to another entity. While it can still be useful to go through the process of determining the best entity for you, if you decide on another entity, be sure you consult with your accountant or tax attorney before switching.

You’ll need organizing documents for C Corps, B Corps, S Corps, Cooperatives, and Non-Profits.

Annual meetings are required for C Corps, B Corps, S Corps, Cooperatives, and Non-Profits.

You can have just one owner in LLCs, C Corps, B Corps, S Corps, and Sole Proprietorships.

LLCs, C Corps, B Corps, S Corps, and Cooperatives can be transferred to others.

Personal Liability is protected within LLCs, C Corps, B Corps, S Corps, Cooperatives, and Non-Profits.

The nonprofit entity is the only entity in which owners cannot make a profit.

The only entity you cannot prioritize a social purpose over making profits is a C-Corp.

These entities do not have to pay taxes: LLCs, S-Corps, Sole Proprietorship, and General Partnerships.

You can potentially get self-employment tax savings in S-Corps.

Non-profits are potentially tax exempt and there’s a potential for donors to receive a tax deduction.

Cooperatives have the potential for favorable tax deductions on business entity’s earnings.

Did you know that members can download this resource as a PDF?