Using this guide

This guide serves to help farmers who provide housing to their workers determine whether the farm is subject to MSPA, and if so, what needs to be done to obtain and maintain compliance. The good news is that certain exemptions apply, including for farms who employ just a few workers as well as family-run farms. This guide is comprised of a flowchart and two checklists. The flowchart provides a basic roadmap to help farmers figure out if by providing housing to workers, they are subjecting their farm to the MSPA requirements. The first checklist provides further explanations of the factors and available exemptions that determine whether MSPA applies. If the factors are met and no exemption applies, the farmer will have to comply with MSPA’s requirements. The second checklist outlines the steps that farmers who are subject to these requirements must take, including having the housing quarters inspected and certified by the appropriate agency, upholding certain housing conditions, making specific disclosures to the workers, and keeping certain records.

Part 1—Overview

Understanding the issue

Farmers often provide housing for their workers, whether on the farm or nearby. Young workers keen to gain sustainable farming experience often see convenient, affordable housing as a perk. It also may be one of the ways farmers compensate their workers—whether seasonal interns, volunteers through exchange programs such as Willing Workers on Organic Farms (known as WOOFers), regular full-time or part-time workers, and the like. Folks who are eager to work on a sustainable farm may have low expectations and graciously accept the simplest of housing conditions. However, farmers should see that the housing provided conforms with federal and state housing laws.

In particular, when a farmer provides housing to “migrant workers,” the farmer may subject the farm business to the federal Migrant and Seasonal Agricultural Worker Protection Act (called the MSPA). Despite what many may believe, “migrant workers” are not limited to out-of-state or foreign workers. Migrant workers include anyone who must stay overnight away from their regular home in order to make it feasible for them to work on the farm. A migrant worker could be someone who regularly lives just an hour or two away from the farm, if such a lengthy drive makes it impractical for them to fulfill their obligations on the farm each day they’re required to work.

The MSPA requires farmers who provide housing to “migrant workers” to arrange an inspection and obtain a certification of occupancy for the housing provided each year. The farmer must also maintain certain housing conditions and follow record keeping and disclosure requirements. If a farmer is not aware of her obligations under MSPA and does not follow the requirements, she may face legal issues including fines and potential lawsuits.

MSPA in a Nutshell

Generally, the MSPA sets minimum work conditions and standards that farms with migrant and seasonal workers must follow. Farmers subject to the MSPA must

• compensate workers adequately;

• safely transport the workers to the workplace if they provide transportation;

• disclose and post certain information about working conditions and rights;

• keep specific records; and

• meet certain safety and health standards if they provide housing.

The focus of this guide is limited to the MSPA’s requirements that kick in when farmers provide housing to “migrant workers.”

What about seasonal workers?

The MSPA establishes minimum working conditions to protect both “migrant” and “seasonal” workers. However, the housing standards of MSPA apply only to migrant workers, as by definition these are the workers who by necessity receive housing by the farm!

For more information on MSPA in general, see the federal DOL website on MSPA: https://www.dol.gov/whd/mspa/. Or, contact the local offices of the Wage and Hour Division of the DOL in your state.

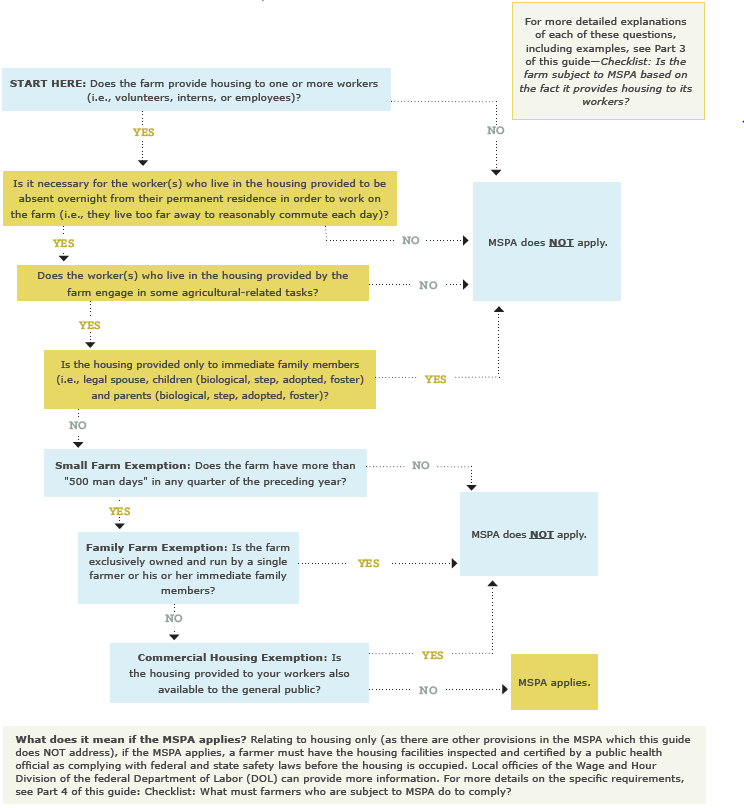

Part 2—Flowchart: MSPA and housing

By providing housing, a farmer may subject the farm to MSPA requirements. Use this flowchart to determine if your farm business may need to comply with MSPA.

Side note: Warning – States may have additional different migrant worker protections—this flowchart and the guide as a whole does not describe state laws.

Part 3—Checklist: Is the farm subject to the MSPA requirements because it provides housing to its workers?

This checklist outlines the factors and available exemptions that determine whether a farm that provides housing to its workers is subject to the MSPA requirements. If these factors are met and no exemption applies, the farm will have to comply with MSPA’s requirements.

Checklist at a Glance

- Does the farm provide housing to one or more workers (i.e., volunteers, interns, or employees)?

- Is it necessary for the worker(s) who live in the housing provided to be absent overnight from their permanent places of residence in order to work on the farm?

- Do the worker(s) who live in the housing provided by the farm engage in some agricultural tasks?

- Is the housing provided only to immediate family members?

- Small Farm Exemption: Does the farm have more than “500 man-days” in any quarter of the preceding year?

- Family Farm Exemption: Is the farm exclusively owned and run by a single farmer or his or her immediate family members?

- Commercial Housing Exemption: Is the housing provided to the farm’s workers also available to the general public?

Checklist with Explanation

Does the farm provide housing to one or more workers (i.e., volunteers, interns, or employees)?

It does not matter whether the housing is on the farm or is owned or even controlled by the farm. It simply has to be arranged and provided by the farm.

Workers in this context generally includes volunteers, interns, and even independent contractors. That’s because in the vast majority of cases, folks who work for farms that operate as for-profit businesses are considered “employees” in the eyes of the law. It does not matter what you call your workers. It also doesn’t matter whether the farm business turns a profit! Basically, folks who work on a farm will be considered “employees” unless one of the three following scenarios applies: (1) the farm is legally recognized as a non-profit organization—in which case you may have unpaid volunteers in certain circumstances, (2) the farm meets the robust legal test for having unpaid interns—in which case you may have unpaid interns, or (3) the farm meets the robust legal test for having independent contractors—in which case federal employment laws generally do not apply. If none of these three scenarios applies, your workers will be deemed employees by the law.

Side note: For more information on volunteers, interns, and independent contractors see Farm Commons’ print resource “Farm Employment Law: Know the basics and make them work for your farm” and our online tutorial “Building a Legally Sound Intern and Volunteer Program for Farm Work.”

Bottom line: If a farmer provides housing in some form to a worker—including volunteers, interns, and employees—the farm may be subject to the MSPA requirements.

Is it necessary for the worker(s) who live in the housing provided to be absent overnight from their permanent places of residence in order to work on the farm?

If the answer to this question is yes, the worker will most likely be considered a “migrant worker” as defined and the farmer would be subject to MSPA unless an exception applies.

Although farmers may not think of their workers as “migrant workers,” many workers including summer interns very well may qualify as migrant workers under the law.

Basically, migrant workers include anyone who must live away from their regular home¬—even if just for one night a week, or a couple nights a month—in order to make it feasible for them to fulfill their obligations on the farm. If the farmer in any way insists that the worker stay on the farm as a condition of employment, the worker would be considered a migrant worker.

But the farmer doesn’t have to expressly insist on it, as it could be that the circumstances themselves force the worker to stay in the housing provided. If there are no other affordable options nearby, yet the working conditions require that she live close to the farm, the worker may feel she has no choice but to accept the housing provided. She would therefore be considered a migrant worker. Let’s say a worker lives a couple hours away and goes home occasionally, or even often, but stays in housing provided by the farm during the week or during busy harvest times because that’s the only way she can practically fulfill her obligations. This worker would be considered a migrant worker.

Bottom line: If you require your workers to live in the housing provided, they will be considered migrant workers. In addition, if your workers feel they have no choice but to live in the housing provided, because they live too far away and there are no other affordable options nearby, they will be considered migrant workers. The farm will then be subject to the MSPA unless an exemption applies. If your workers live at their own homes, they will not be considered migrant workers. Also, if your workers live nearby or if they have other affordable nearby options and yet they genuinely prefer to live on the farm in the housing you provide, they will not be considered migrant workers.

Do the worker(s) who live in the housing provided by the farm engage in some agricultural tasks?

Another factor that perhaps goes without saying is that the MSPA only applies to workers engaged in “agricultural employment” as defined by the statute. This basically includes all services performed on a farm in connection with the farm operation. The MSPA definition is quite broad and extends to handling, planting, drying, packing, packaging, processing, freezing, or grading of any agricultural or horticultural product in its unmanufactured state prior to delivery for storage. It would be hard to imagine a scenario where a farm worker would not be engaging in any of these activities! But it may be possible. For example, if the farm assigns their workers only tasks related to organizing agritourism events and they don’t do any tasks involving the farm’s agricultural or horticultural products, the farmer may be able to make a case that the MSPA does not apply.

Bottom line: If the migrant worker who lives in housing provided by the farm engages in any sort of agricultural task, the farm will be subject to the MSPA requirements unless an exemption applies.

Side note: MSPA’s definition of “agricultural employment” is broader than the definition of “agricultural labor” provided in the federal Fair Labor Standards Act (FLSA) for purposes of minimum wage and overtime exemptions, as well as the definition provided in the Internal Revenue Code for purpose of payroll tax exceptions. For MSPA see 29 CFR 500.20 (e), for FLSA see 29 U.S.C. 203(f), for the IRC see 26 U.S.C. 3121(g).

Is the housing provided only to immediate family members?

The MSPA housing standards do not apply if the housing is provided just for immediate family members. The immediate family includes only the legal spouse, children (biological, step, adopted, foster), and parents (biological, step, adopted, foster). Notice that immediate family does not include brothers, sisters, aunts, uncles, cousins, nieces, nephews, in-laws, grandparents, grandchildren, and so on.

Bottom line: If the farmer provides housing to migrant workers who are not within his or her immediate family, the farm will be subject to MSPA unless an exemption applies.

Small Farm Exemption: Does the farm have more than “500 man-days” in any quarter of the preceding year?

To determine whether the MSPA’s small farm exemption applies to your farm, you have to apply the “500 man-day rule” which involves some math. Basically, farms who used over 500 “man-days” of agricultural labor in any calendar quarter will be subject to MSPA. Farms that used 500 or less man-days are exempt from all MSPA requirements. Two steps are required to determine whether this small farm exemption to the MSPA applies to your farm.

o 1st Step: What was your busiest “calendar quarter” last year?

The calendar quarters are January through March, April through June, July through September, and October through December. Which of these was your busiest quarter last year (i.e., when did you employ the most workers)?

o 2nd Step: How many “man-days” did you employ?

To answer this, you need to know what a man-day is. One man-day is any day on which a person does at least one hour of agricultural work (i.e., work in the field or on the farm processing, packaging, delivering, or preparing the farm’s products for market). Each person who works is counted as a separate man-day. For example, if three individuals work for one hour each on the same day, the farm has three man-days. If three individuals work for eight hours each on the same day, the farm still has three man-days.

When calculating man-days, farmers must include all workers—not just “migrant workers” who live in housing provided by the farm. However, immediate family members are not counted when determining man-days. Immediate family includes only the legal spouse, children (biological, step, adopted, foster), and parents (biological, step, adopted, foster).

As a rough estimate, 500 man-days generally equates to about five to six full-time employees. This will of course depend on how many days a week your employees work one hour or more. Farmers must keep careful records of who worked on which days and for how long each individual worked, if they wish to use this exemption.

Side note: The 500 man-day rule is the same rule that applies when determining whether the farm is exempt from paying the federal minimum wage and overtime requirements under the Fair Labor Standards Act (FLSA). Many, but not all, states have adopted the same rule for exemptions to their state minimum wage and overtime requirements.

Side note: The small farm exemption applies to all of the MSPA requirements, including employment standards related to wages, housing, transportation, disclosures, and recordkeeping.

Bottom line: Farms who used over 500 “man-days” of agricultural labor in any calendar quarter of the previous year will be subject to MSPA. Farms that used 500 or less man-days fall within the small farm exemption and will not be subject to any of MSPA’s requirements. Farmers who wish to take advantage of this exemption must be sure to keep records such as timesheets to prove they had less than 500 man-days each quarter.

Family Farm Exemption: Is the farm exclusively owned and run by a single farmer or his or her immediate family members?

The MSPA requirements do not apply to farms that are owned and operated entirely by a single farmer or his or her immediate family members. Again, the immediate family includes only the legal spouse, children (biological, step, adopted, foster), and parents (biological, step, adopted, foster).

Also, for this exemption to apply, all of the recruitment, soliciting, hiring, housing, employing, and transporting of the farm’s workers must be conducted by the farmer or members of the farmer’s immediate family. For example, if the family farm works with a consultant to manage the recruiting and hiring of its workers, this exemption would not apply.

If the farm qualifies for the family farm exemption, the farm is exempt from all of the MSPA requirements not just the housing requirements.

Side note: The family farm exemption applies to all of the MSPA requirements, including employment standards related to wages, housing, transportation, disclosures, and recordkeeping.

Bottom line: So long as all the folks in your farm business are immediate family members and they’re the ones taking full responsibility for all aspects of the workers, the farm will not be subject to any MSPA requirements. But if you’re in business with a group of friends or unrelated partners, then the MSPA may apply.

Commercial Housing Exemption: Is the housing provided to your workers also available to the general public?

If the farmer is in the business of commercial housing and rents out the quarters to the general public, not just to her farmworkers, the farmer would not be subject to MSPA. This is because in this case, the farmer-landlord would have to already comply with state and local housing laws. For this exemption to apply, the housing provided to the migrant workers would have to be the same quality and character as that provided to the general public, and under the same or comparable terms. For example, the farmer would have to follow the same eviction and rent policies. She could not simply kick workers out if and when she fires them or if they quit.

Side note: The commercial housing exemption only applies to MSPA housing requirements. The farm may still be subject to other MSPA requirements for seasonal and migrant workers including wages, transportation, disclosures, and recordkeeping.

Bottom line: If the housing you provide is also available to the general public and if the quality of the housing and policies you follow are the same for your workers as they are for the general public, then the MSPA housing requirements do not apply.

Part 4: Checklist: What must farmers who are subject to MSPA do to comply?

Farmers who provide housing to “migrant workers” and do not fall within an exemption must adhere to the following requirements to be in compliance with MSPA. These include having the housing quarters inspected and certified by the appropriate agency, upholding certain housing conditions, making specific disclosures to the workers, and keeping certain records.

Arrange for a pre-occupancy inspection, obtain a certification of occupancy, and maintain applicable housing standards

Any housing that will be occupied by a migrant worker must be inspected and certified for MSPA compliance by the appropriate state or local agency. The certification of occupancy is good for only one year. Thus, this inspection and certification process must take place each year that housing is provided to migrant workers.

The Wage and Hour Division of the federal Department of Labor (DOL) is the primary agency responsible for conducting pre-occupancy inspections. Oftentimes, the DOL works with the state’s central labor and employment agency who will conduct MSPA inspections. Farmers should contact the regional federal DOL office in their state or their local extension agent to find out who to contact to arrange for a housing inspection.

The inspection must be done before the housing is occupied. To ensure that this happens, the farmer must call the appropriate agency to arrange for an inspection at least 45 days prior to scheduled occupancy. If the farmer contacts the agency at least 45 days out and the agency fails to inspect the premises within this timeframe, the farmer can go ahead and allow migrant workers to occupy the housing without the inspection. Farmers should keep records of any phone calls, emails, or letters they send to the agency to show that the farmer did in fact make contact within the allotted time.

The inspector will look to ensure that the housing provided complies with all applicable federal and state safety standards. At a minimum, the housing must comply with the federal housing standards. Generally speaking, the housing must be well-constructed and provide fire prevention, an adequate and sanitary supply of water, plumbing maintenance, adequate heat, and reasonable protections from inspects and rodents. The MSPA also requires that the housing comply with state health and safety standards, which may be more stringent than those required at the federal level.

Farmers should contact their local extension agent, state labor and employment department, or even their local librarian to find out more about the specific MSPA housing standards that are applicable in their state.

Side note: The federal housing standards referred to in the MSPA are those established by OSHA (29 CFR 1910.142) and the Employment and Training Administration (20 CFR 654.404).

Properly disclose the terms and conditions of housing to all migrant workers

The certification of occupancy that the farmer receives by the inspector must be posted at the housing site at all times.

In addition, the farmer must display a poster or provide each worker a written statement of the terms and conditions of occupancy. If it the information is posted, it must be in a place on site where it can be seen and read by all occupants. Alternatively, a written statement can be given to each worker prior to occupancy. Either way, the poster or written statement must include the following information:

o name and address of the farmer providing the housing

o name and address of the individual in charge of the housing

o mailing address and phone number where persons living in the housing facility may be reached

o who may live at the housing facility

o charges to be made for housing

o meals to be provided and charges to be made for them

o charges for utilities

o any other charges or conditions of occupancy

Farmers may fill out and use a form provided by the federal DOL, WH Form 521 – Housing Terms and Conditions (PDF), to satisfy this requirement. This form is available online: https://www.dol.gov/sites/dolgov/files/WHD/legacy/files/wh521.pdf.

Properly disclose employment terms to all migrant workers at the time of recruitment

All farmers who are subject to MSPA must disclose information about the work arrangement when the farmer is recruiting a migrant or seasonal worker. This information must be in writing and in a language that is understood by the worker. The following information must be disclosed at the time of recruitment:

o place of employment

o wage rates to be paid

o kinds of activities the worker will be doing and crops involved

o time period of employment

o transportation, housing, and any other benefits to be provided along with any costs to be charged for each

o workers’ compensation information (including whether it is provided, and if so, the name and contact information of the insurer and details of the policy)

o whether there’s an ongoing strike, work stoppage, slowdown, or interruption of the farm’s operation by workers

o whether the farmer or anyone else gets paid a commission for items that may be sold to the workers

The farmer must also display a poster at the job site that sets forth the rights and protections of the workers under the MSPA. The poster must be in a visible place where workers frequently visit. The posters are available in several languages on the Department of Labor website: https://www.dol.gov/agencies/whd/agriculture/mspa.

Follow wage and compensation standards and procedures

All farmers subject to MSPA are also required to comply with certain wage and payment standards. Farmers must pay all migrant and seasonal workers their wages when due, which must be no less than every two weeks (i.e., semi-monthly). Farmers must also give these workers itemized, written statements or paystubs of earnings each pay period. The written paystub must include the following:

o name, permanent address, and Social Security number of the worker

o basis on which wages are paid

o number of piecework units earned, if paid on a piecework basis

o number of hours worked

o total pay period earnings

o any amount deducted and the reasons for the deduction

o net pay

Maintain required records

Farmers must keep complete and accurate payroll records for all migrant and seasonal workers for three years. These records must include all of the information required to be included on the written paystub.

Follow applicable transportation standards

Farmers must ensure that vehicles used to transport migrant and seasonal workers are properly insured, are operated by licensed drivers, and meet all federal and state safety standards.

Conclusion

Farmers who are subject to MSPA and fail to comply face steep penalties. It can be up to $10,000 per violation. Criminal convictions may result in up to three years in prison and $10,000 fines for repeated violations. In addition, seasonal and migrant workers whose rights have been violated may file lawsuits seeking money damages in federal court. MSPA also protects the children and spouses of farm workers who are living with the worker on the farm, even if they are not employed by the farm or otherwise engaged in agricultural tasks. Therefore, others who live in the housing provided by the farmers, including the workers’ friends and relatives, may also seek damages in federal court if the housing conditions are substandard or their rights are otherwise violated.